The Ukrainian paper and board industry has come to a standstill following the invasion of the country by Russian forces, according to the head of the Ukrainian association of paper and board producers Ukrpapir.

“[Vladimir] Putin has entered Ukraine from almost all sides and is waging a bloody war, including against the civilian population, women and children, stated Ukrpapir director Eduard Litvak to Fastmarkets’ publication PPI Europe.

Almost all paper and board producers suspended production on February 24. The reason is clear – the war.

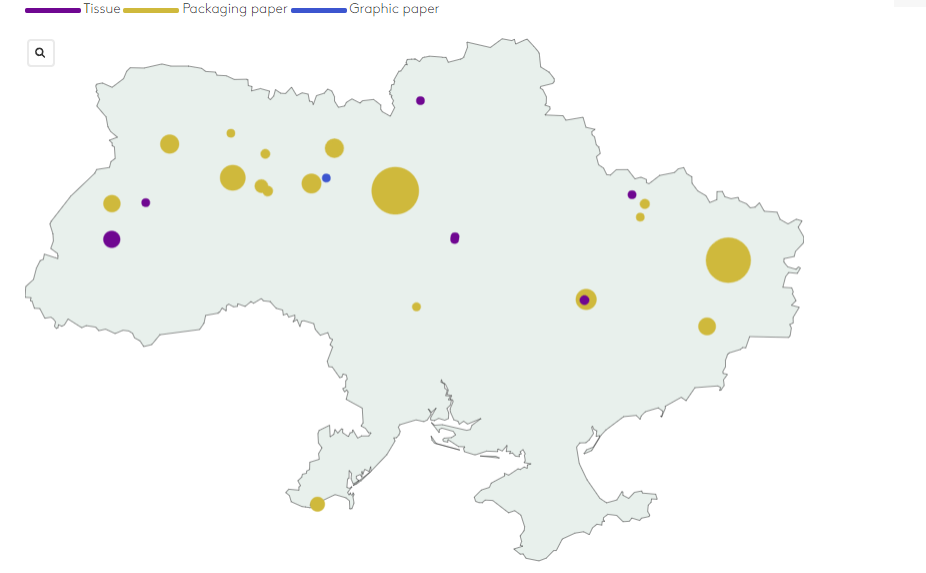

Ukraine produces approximately 1.2 million tonnes of paper and board annually, according to Fastmarkets RISI’s economic analysis team. The country’s biggest producers include the Kyiv Cardboard and Paper Mill (KCPM), which accounts for approximately 30% of Ukraine’s total paper and board output, and the Rubezhansky Cardboard and Packaging Mill, a DS Smith joint venture.

War suspends Ukraine mill operations

A KCPM representative confirmed that the plant had suspended operations. “We have stopped production and the guards are protecting the mill. All paper and board production in Ukraine has stopped – it is real war,” a KCPM representative said. They continued:

All of our funds are going to protect the country.

At the company level, a flurry of announcements have been made by firms with operations in Russia and Ukraine or doing business in the countries.

Stora Enso announced Wednesday that it would stop all production and sales in Russia until further notice due to the ongoing invasion of Ukraine. It will also halt all exports and imports to and from the country. “The war in Ukraine is unacceptable and we are fully behind all sanctions. We will now focus all our attention on supporting our customers and the wellbeing of our employees,” the firm’s CEO Annica Bresky said in a statement.

Stora Enso has three corrugated packaging plants and two sawmills in Russia and employs some 1,100 people there. The company’s sales in Russia account for approximately 3% of total group revenues and the impact on its sales and EBIT is not material, according to the firm.

Mondi, which has operations in Russia that total some 12% of its production revenue, said in a statement that their facilities in Russia were operational, but that its sole bag plant in Ukraine, west of Lviv, had suspended production. Some 100 workers are employed there.

Germany’s Leipa issued a statement saying that logistical bottlenecks appeared to have worsened since February 25 and that while it would stand by its customers, there would be “postponements, delays and cost increases in the coming weeks.”

Chemical producer Kemira, which obtains around 3% of its total revenue from Russia, said on Tuesday that it would discontinue deliveries to both Russia and Belarus as of March 1 and until further notice citing the “ongoing situation in the region.”

Ukrainian packaging mill employees devastatingly impacted

The Prinzhorn Group’s Dunapack Packaging, which operates two sites in Ukraine, in Oleshky and Hodorov, released a scathing statement detailing the death of its employee Pawel Borisov, a 21-year-old box-making line operator at the firm who was caught in crossfire and killed. Two other employees had their homes destroyed by bombs. “The rest of our colleagues are scattered all over, from cellars to bomb shelters to days-long queues on the borders trying to cross over to the EU,” Dunapack said.

The firm said it was “forever grateful” to its colleagues in Poland, Hungary, Romania and Bulgaria who were taking care of their Ukrainian colleagues when they managed to cross the border. “Several shells have hit our corrugated packaging plant. It is enraging and incomprehensible to see your former office destroyed. This war is meaningless. It needs to stop now,” the firm said.

Late yesterday, the International Paper spinoff Sylvamo said it was considering curtailing or temporarily shutting down pulp and paper production at its Svetogorsk mill in Russia at the end of this week due to “inadequate supplies of critical raw materials.” The mill is currently operating while the firm takes steps to mitigate supply chain issues. The mill, which is located in western Russia on the border with Finland, can produce some 720,000 tonnes per year of pulp, paper and board.

Varying global and local trade fallout

While the situation is still very much in flux, there can be no doubt that there will be varying levels of fallout both at a narrow, regional level and more broadly.

In terms of paper and board production and trade, the impact on global markets should be limited, even for Europe, according to Fastmarkets RISI’s director Europe packaging paper and graphic paper Alejandro Mata.

Ukraine, with its 1.2 million tonnes of paper and board capacity, of which some 750,000 tonnes is containerboard, accounts for less than 2% of Europe’s total paper and board capacity, according to Mata, with most of that going to the domestic market.

source: Fastmarkets.com